Selling, Buying & The Awkward Time In Between

In today’s market, selling you r home should be easy and relatively quick (if it is priced right). Buyers are out in numbers and inventory is low, placing us right in the middle of a strong seller’s market. However, if you are also planning on buying a home, you will be competing with many buyers to find your replacement property and probably will have some difficulty aligning the closing of escrow on both homes for a seamless move from your current home to the new one.

r home should be easy and relatively quick (if it is priced right). Buyers are out in numbers and inventory is low, placing us right in the middle of a strong seller’s market. However, if you are also planning on buying a home, you will be competing with many buyers to find your replacement property and probably will have some difficulty aligning the closing of escrow on both homes for a seamless move from your current home to the new one.

As you think about this big move, you have probably wondered about the best way to transition from one home to another and how to manage the timing of it all. Do you buy the new home first and then sell your current home, or sell first and then buy? Do you rent during the interim or try to time the sales perfectly so that you can move directly into the new home? .

Here is a basic summary of the options that are available to you:

Option #1: The Seamless Transition – This is of course the ideal situation, when you close on the sale of your current home at the same time (give or take a couple days) as the closing of your new home! This involves only one cumbersome moving experience and no interim rental. This is of course very difficult to time and rarely happens. Furthermore, it requires the purchase of your new home to be negotiated contingent on the sale of your current home. In a “Seller’s Market,” it is difficult to get sellers to agree to these contingent offers.

Option #2: Sell First, Buy Later – This is perhaps the most common situation where most people find themselves in today’s unique market. Many times, this approach is necessary, as many people need the equity from the first house to pay for the down payment of the new home. When this happens, usually there is an interim time between close of escrow on the first home and the time you close on your new home. This can be a couple weeks. Sometimes it can be a few months or more. This leaves you with the options of staying with family or friends, renting a short-term interim space, or negotiating a rent-back situation with the buyers of your current home. The latter is often the most appealing of the three, as you only have to move once and you can sometimes negotiate a better than market rental rate for the extra time you stay past the close of escrow. However, if a “rent-back” situation is not available, then the only option is moving into interim housing – family, friend or rental.

This strategy does have some positive elements as it may help you to present stronger offers on the purchase of the new home. You can write offers that are not contingent on the sale of your current home and you will have the full equity in cash from the sale of the first home to put toward the new one – strengthening your offer and negotiating position when competing with other buyers. Finding a place to live in the interim can also give you the time you need to really find the house you want – less rushed than trying to sell and buy simultaneously.

Option #3: Buy First, Sell Later – This option usually only works for those that can qualify for the loan on the new purchase while maintaining the loan on your current home (or those that are purchasing new home with all cash). The benefit of this is that you have time on your side. You can buy at your leisure, fix up your new property before you move in if you like, and choose a time to sell your current place that is convenient for you. It is then easier to clean, stage and prepare you home for sale once you have already moved on to your new place.

**There are other factors that contribute to timing as well, and as you can probably see, everybody’s individual situation requires a unique approach to the issue of timing! Moving is always a stressful event in our lives, but good planning, quality advice, and a good agent that works hard for you will help make the transition as smooth as possible! : )

– Justin McNabb, Realtor

Update to Flood Insurance

Just a week ago, congress passed a bill that effects most people whose homes lie within flood plains. Flood insurance rate increases, though stayed a little by this recent bill (HR3370), will be on the rise. This could effect the marketability and even the value of your home if you are in a designated flood zone.

This video gives a very short update on the recently passed bill.

Where are we going with lending and interest rates?

One paragraph prediction of where the lending/mortgage market is going (in my opinion):

![]() With Bernanke leaving at the beginning of the year and the high likelihood of Janet Yellen taking over the Fed, a good look at her general approach to the economy leaves us with a pretty good idea of where she may lead the Fed, interest rates and the secondary lending market regulations. Leaning more toward an economically dovish (rather than a hawkish) approach, it is likely we will see her favoring keeping interest rates low (favoring job creation over inflation control). It is also likely one of her first orders of business will be to slowly reduce the Fed’s holdings in the mortgages and treasury markets. Because of this and some new policies already set in motion and ready to take effect at the beginning of the year (i.e. debt-to-income ratio changes, more regulations on Arm loans, etc.) we will likely see it a little harder to qualify for the same amount that one may be able to get today.

With Bernanke leaving at the beginning of the year and the high likelihood of Janet Yellen taking over the Fed, a good look at her general approach to the economy leaves us with a pretty good idea of where she may lead the Fed, interest rates and the secondary lending market regulations. Leaning more toward an economically dovish (rather than a hawkish) approach, it is likely we will see her favoring keeping interest rates low (favoring job creation over inflation control). It is also likely one of her first orders of business will be to slowly reduce the Fed’s holdings in the mortgages and treasury markets. Because of this and some new policies already set in motion and ready to take effect at the beginning of the year (i.e. debt-to-income ratio changes, more regulations on Arm loans, etc.) we will likely see it a little harder to qualify for the same amount that one may be able to get today.

Even though the Fed has already said they intend to help move interest rates back toward a more historically normal number, Yellen’s policy approach, along with some economic uncertainty demonstrated (or caused?) by the current congressional and governmental stall, will probably result in continued low rates for the next couple quarters.

Summary In Short: Interest rates probably will remain fairly low well into 2014 before they start their slow rise toward “normalcy”, but starting January first, you may not be able to qualify for quite as much or as easily!!

Okay…so I couldn’t keep it to just one paragraph…but come on people, this is complicated stuff!! : )

The Story of a Home

The Story of a Home

I love the idea of thinking about our lives as a story. Every good story has meaning and purpose, drawing the reader in, giving them something to identify with. There are main characters, a plot & sub-plots, context, history, conflicts, and resolution (sometimes). Sometimes we play a large part in the crafting and creation of our own stories & and sometimes circumstances are thrust upon us, shaping the direction of our story. No story however, has significant meaning without the joyful triumphs and the painful experiences that punctuate the background story of one’s life.

What intrigues me most, is how stories intertwine as people cross paths. The story of one person affects the story of another. Indeed, the story of a community is simply the story of how the lives and stories of individuals interact. We see this in the smaller communities of family and friends and work, or in the larger communities of cities, regions and even nations.

And no story makes sense without location, a place for that story to take shape. Over time, even the land itself seems to develop a story and sometimes even a story that goes beyond the people who have lived there. One of the things I love about real estate is that it represents the intersection of the story of people and the story of a place. What people do and don’t do in a particular place, defines the story of that land. And likewise, often the layout of the land or the design of a building often defines how people use and live in that home or workplace. A home with a pool will define part of the story of those that live there. A home close to the city center or near a school can greatly affect the story of the people that live in that home. Is there a garden, an extra bedroom for guests, outdoor space, etc? All these things speak to the kind of story that will take place in that home. Sometimes even the layout of a house can affect how a family interacts with one another.

The individual and collective stories of families is what gives meaning to the home. After all, doesn’t most of our story take place in our homes, both the good and the bad – growing up, marriage, entertaining of friends, raising our children (sometimes even their births) and growing old. It is where most of our big decisions are made, where meaningful discussions are had, where our joy is fullest and sometimes where our pain is deepest. Whatever our stories may be, the homes we have lived in will forever be a part of our lives, and in part, defined a little piece of our stories!

I am currently representing some clients that are in escrow on a beautiful Santa Cruz home built in 1910. As we researched the house, talked to neighbors, gathered documents from the county, we have been able to piece together a little bit of the story of this very unique home. When at the county building pulling records, we discovered the county official helping us lived in the same house from 1955-1968. Piecing together her story with the story of other owners and neighbors, my clients got a deeper picture of the story of the home and how their story will interact with and add even more beauty and depth to the story of this home.

Choosing a home is like setting a stage for a play. It sets the tone and boundaries of the story that is going to be played out. It becomes a permanent piece of everybody’s story that lives in that home – a vault for the memories you and your family will carry with you.

What kind of story do you want to live in?

Today’s Market and Where We Are At

Today’s Market Update

08/03

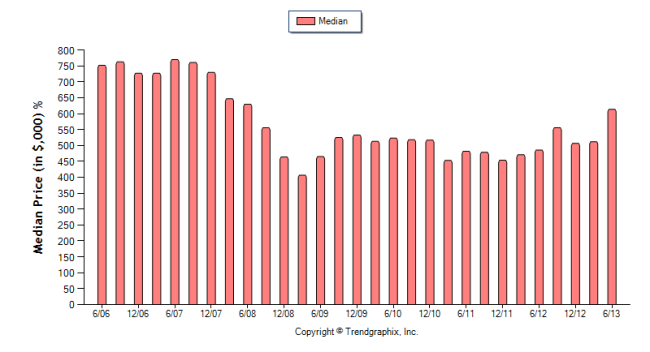

The real estate market in Santa Cruz County has been an amazing and interesting market to follow this last year. But to understand where it is at today, we need to take a brief look at where it has been. The chart below shows the median single family home price for Santa Cruz County for the last seven years.

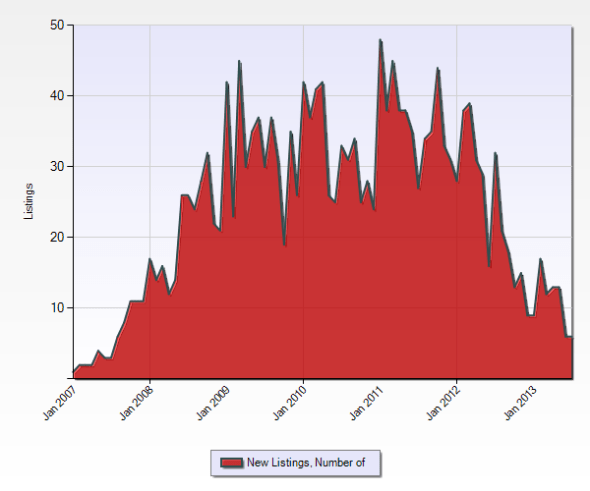

The huge decrease in value from 2007 to 2009 is obvious and unforgettable for most of us who owned a home during that time. It was painful as the depressed market got flooded with foreclosures, REO’s and short sales. You can see that while the home prices in Santa Cruz stayed low (relatively speaking) during 2010 and 2011, foreclosures and other distressed homes sales where through the roof. See Chart Below!

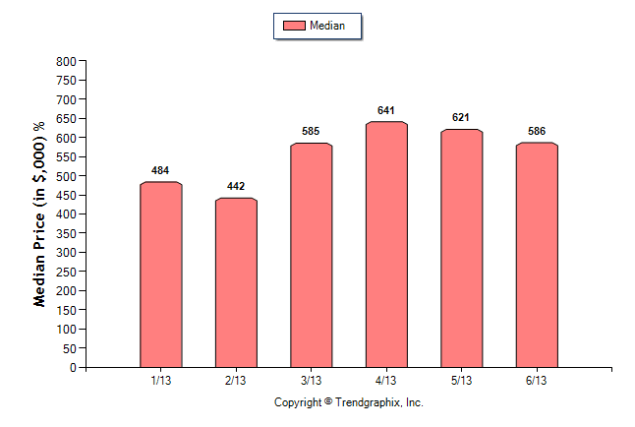

In the first quarter of 2012, distressed properties began to represent a smaller and smaller percentage of homes on the market. As distressed properties waned, sale prices (and market traction) began to put feet on solid ground. Investors who had been waiting on the side lines for signs of a recovering market, began to see reason to jump back into the real estate market. Motivated by historically low interest rates and a hope that we had probably seen the bottom of the barrel, lots of new buyers flooded the market. Demand was high. On the other hand, supply was low. Everybody had lost incredible amounts of money in equity and many were under water (and still may be). Nobody wants to sell just when the market is turning around (and many felt like they simply couldn’t). This low supply coupled with the high demand was the catalyst for this frenzied seller’s market we have seen the first six months of 2013. And as typical for things in low supply, but high demand, prices have soared. This next chart shows the median price of a single family home in Santa Cruz County from January to June of this year.

Two things to notice here: First, the median listing price in June is $102,000 more than the average in January – that’s an increase of 21% in just six months. That is incredibly fast growth. While this was wonderful for the market and a great sign for home owners, it isn’t a sustainable speed of recovery and ultimately would lead to an unhealthy market if it continued for too long. Second, by the end of Spring, home prices began to be effected by the newly rising interest rates and the entrance of sellers back to the market in growing numbers. Sellers had determined there had been enough rise in price to begin listing their homes again. The increase in supply and a slightly less frenzied demand is steadying the market to a much more “normal” pace. Buyers are still out in numbers and inventory is not even near too much, but I think we are seeing the slowing of one of the quickest rise in prices we have seen in a long time.

What I hope to see (and believe we will) is a return to a slower pace of growth (with its smaller ups and downs) to pull us the rest of the way out of the housing pit that most had fallen into.

So…it is a good time to take a breath, evaluate what our short and long term real estate goals may be, and ask if it is the right time to make any changes!

Being A Part of Peoples’ Story

Real Estate is a “people business.” What are homes if you don’t have people living in them, and businesses if you don’t have people working at them?

The other day, I got a phone call from an elderly lady who was requesting information on a condo she was interested in purchasing. I couldn’t email her the info she wanted because she had no computer or internet access in her home. So I did it like realtors of years past – printed everything out and delivered it to her door.

She was a sweet lady and it quickly became apparent that what she really wanted was somebody to talk to. Her husband recently passed away and she was feeling lonely. We had a good conversation about real estate, and a great conversation about her life, her past and some things she is currently struggling with. I was a bit amazed at how she opened up her story to me, but thankful that I was able to connect with her, engage her, and hopefully encourage her a bit too.

In the end, she told me, “I like you young man and when I am ready to move, I want you to list my house and help me buy another.” Though I was happy to hear this, I could tell from our conversation she wasn’t really ready to move anytime soon. But perhaps an even better compliment was the trust she placed in me as she invited me into her story!

I love the business side of real estate – the investing, financing, legal/risk management, and transaction management. But I am continually surprised at the way it often places me in the middle of peoples’ lives; even in the middle of some challenging and emotional times of transition. I count it a privilege not only to be trusted with the business of real estate, but to be trusted with part of my clients life story!

Recent Comments